All amounts in U.S. dollars unless otherwise indicated

Brookfield Renewable Partners L.P. reported financial results for the three and six months ended June 30, 2025.

“We had another strong quarter and further solidified our position as a partner of choice to the largest buyers of clean power, signing a first of its kind agreement with Google to deliver up to 3,000 megawatts of hydro power in the U.S.—a testament to the unique capabilities we can provide to the best global businesses and technology companies,” said Connor Teskey, CEO of Brookfield Renewable.

He continued, “We were also successful investing in a number of highly accretive platforms and assets, such as increasing our stake in Isagen, one of our world-class hydro businesses. With scale capabilities in hydro, nuclear, wind, solar and batteries, we continue to differentiate ourselves as the global leader in providing diverse and scaled energy solutions that are critical to energy grids and needed to meet the tremendous growth in electricity demand.”

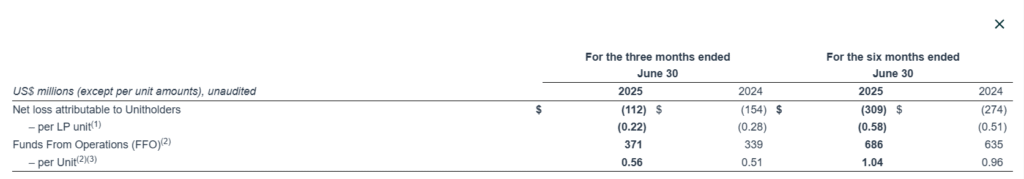

Brookfield Renewable reported record FFO of $371 million in the quarter, or $0.56 per unit, up 10% year-over-year benefiting from strong underlying operating results across our business, underpinned by our stable, inflation-linked and contracted cash flows. Our results also reflect execution of our ongoing commercial contracting activities and growth initiatives. After deducting non-cash depreciation and other expenses, our Net loss attributable to Unitholders for the three months ended June 30, 2025 was $112 million.

Key highlights:

- Advanced commercial priorities securing contracts to deliver an incremental ~4,300 gigawatt hours per year of generation and signed the first of its kind Hydro Framework Agreement (“HFA”) with Google to deliver up to 3,000 megawatts of hydroelectric capacity in the U.S.

- Committed or deployed up to $2.6 billion (~$1.1 billion net to Brookfield Renewable) across multiple investments, including growing our exposure to critical, scale, baseload power generating assets.

- Continued to execute our asset recycling program, generating ~$1.5 billion (~$400 million net to Brookfield Renewable) in expected proceeds since the start of the second quarter, delivering strong returns and proceeds for reinvestment into growth.

- Strengthened our balance sheet and ended the quarter with ~$4.7 billion in liquidity. The quarter was highlighted by the issuance of C$250 million of 30-year hybrid notes at the tightest corporate hybrid new issue spread and reset spread ever in Canada. We also successfully executed a €6.3 billion (~$7 billion) project financing for Polenergia’s offshore wind development in Poland, the largest ever project financing for our business.

Discover the latest trends and insights—explore the Business Insights Journal for up-to-date strategies and industry breakthroughs!